FTAI Infrastructure Faces Liquidity and Dilution Risks as SEC Declares Registration Effective

After the market closed on Wednesday, the SEC issued a notice of effectiveness for a registration statement filed last week by FTAI Infrastructure, Inc. (FIP). Shares of FTAI fell 5% to $6.29 per share before the market opened on Thursday and then faded throughout the day to close at $6.09.

The market appeared to acknowledge that the SEC had opened the floodgates to a deluge of freshly minted shares from FTAI. The company can now issue shares underlying its Series B convertible junior preferred stock as well as shares issuable upon exercise of 550,000 new warrants and up to 7 million additional warrants for which the Series B preferred stock can be redeemed at FTAI's discretion.

The conversion price of the Series B preferred stock is $8.18 per share (with anti-dilution adjustments). Stockholders can convert the preferred shares to a maximum of 19.6 million common shares (or 22.2 million if the preferred stock dividends are paid in kind). Alternatively, FTAI can redeem the preferred stock within two years for cash worth 120% of the liquidation preference plus 43.75 warrants per preferred share. The new warrants would complement the outstanding warrants FTAI has already issued, which numbered 3.89 million as of Mar. 31, 2025. Each of those warrants is exerciseable for one common share at a weighted average price of $9.76.

A worst-case scenario would ensue if stockholders converted the Series B preferred stock to the maximum number of common shares (22.2 million) and exercised all of the 3.89 million existing warrants. The result would increase FTAI's common shares outstanding by about 23%. If, instead, FTAI redeemed all of the Series B preferred stock for cash and warrants, and shareholders exercised the new warrants in addition to the 3.89 million existing warrants, common shares outstanding would increase about 10%.

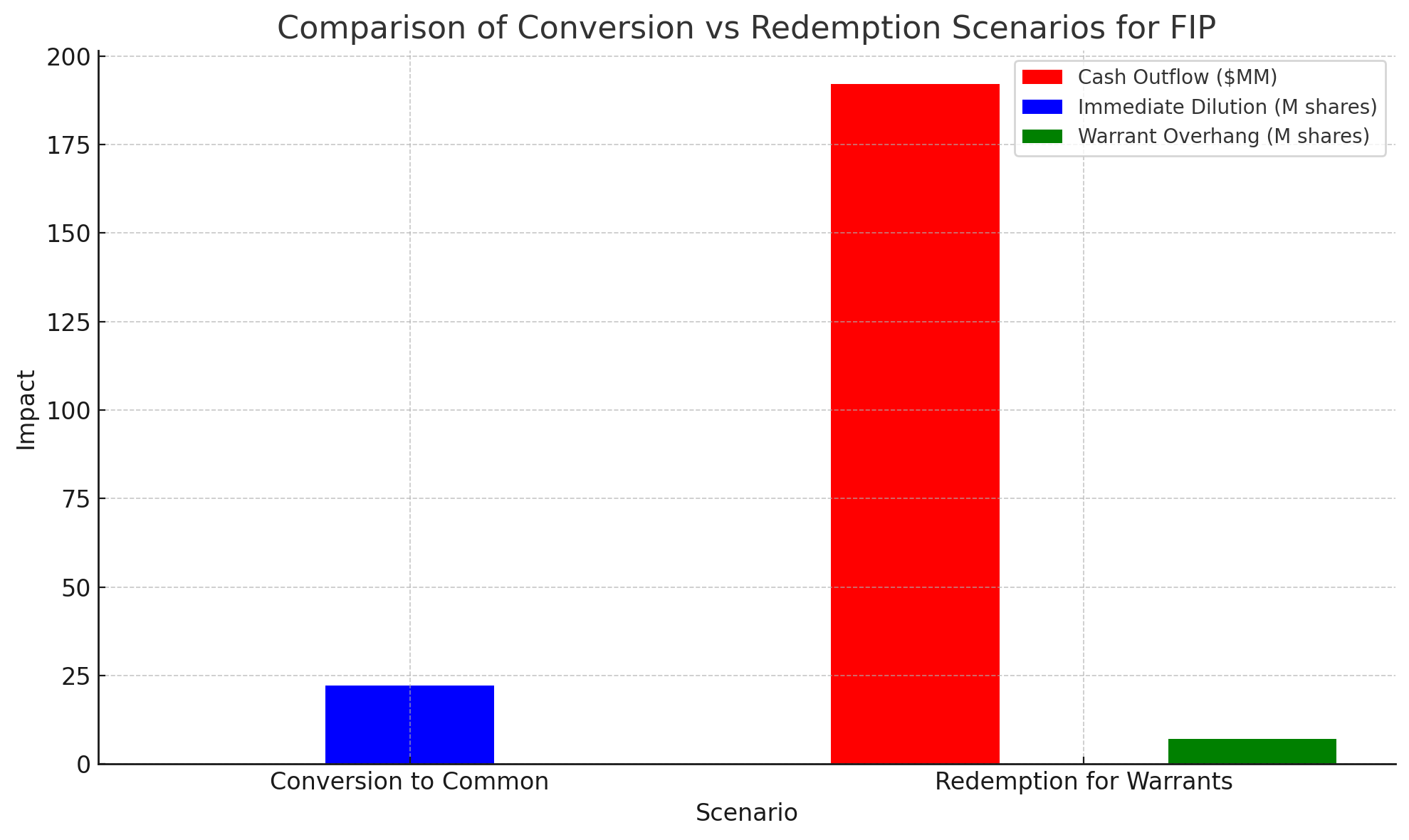

FTAI's management will ultimately decide how stockholders dispose of their Series B preferred shares. On the one hand, redemption would limit dilution of common shareholders but would require the company to pay out as much as $192 million in cash and leave an overhang of up to 7 million warrants. On the other hand, conversion would use no cash but would likely result in rapid dilution and a quick drop in the stock price.

As of Mar. 31, 2025, FTAI had $26 million of unrestricted cash, $197 million of restricted cash, and a quarterly burn rate of $85.7 million. An outflow of $192 million could cause a short-term liquidity crisis and require the company to raise capital on unfavorable terms. That's why we believe conversion is more likely than redemption.

But either scenario will put downward pressure on the stock price, albeit for different reasons and at different times. We expect increased volatility in the stock price now that the registration is effective. We will aim to enter a short position near $6.50 per share and cover around $5.00 per share, which is a recent support zone.

Member discussion