Newsmax Stock in Danger: 146 Million Shares Now Registered for Resale

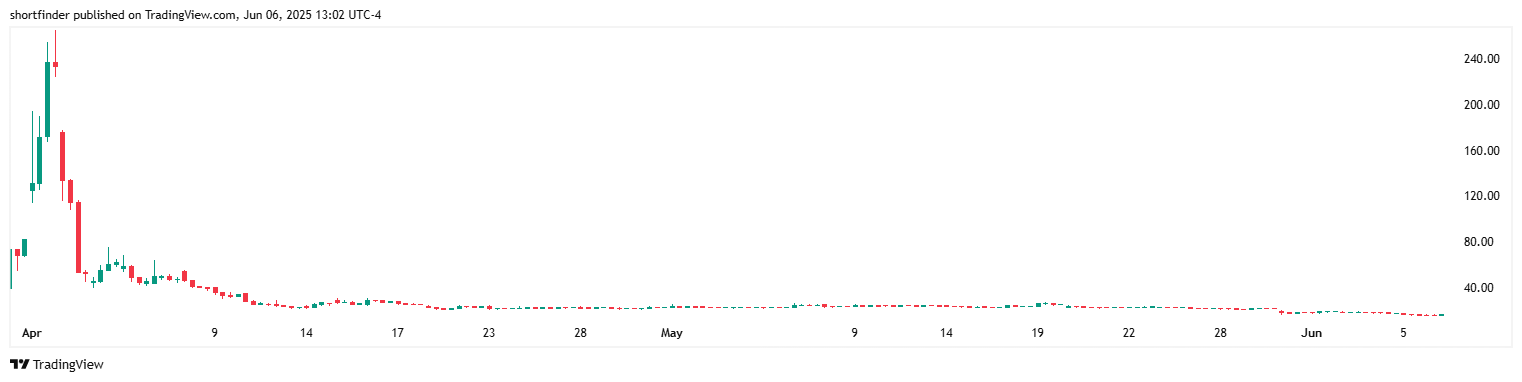

Yesterday brought no news about Newsmax, Inc. (NMAX). Yet the company's stock fell 10% to close at $16.19. Some outlets speculated that the rift between Elon Musk and Donald Trump caused "Trump Trade" stocks like Newsmax to tumble. We have another theory.

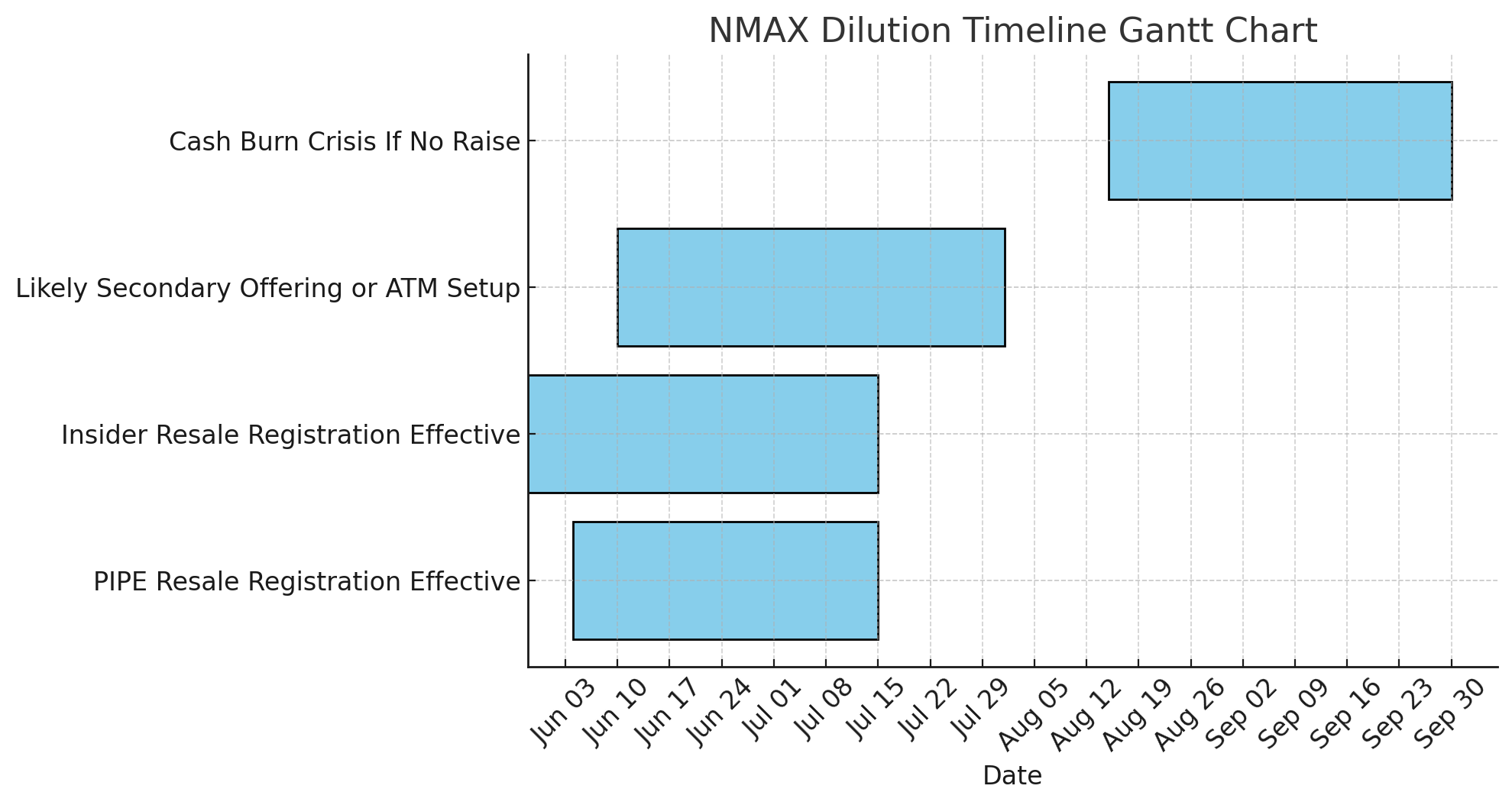

On Wednesday, the SEC declared effective a resale prospectus for up to 25.6 million shares of Newsmax Class B common stock by hedge fund YA II PN, Ltd., managed by notorious dilution enabler Yorkville Advisors Global, LP. But that's modest compared to the prospectus declared effective last week, which registered 121.2 million shares held by more than 8,000 insiders who invested before Newsmax went public in April 2025.

This isn’t just an insider exit—it’s a structured unloading. These stockholders can now begin dumping shares that could flood the float and crush support levels if volume persists. More than half the current float is now registered for resale. Even if half the registered shares are sold, the market may need to absorb three to four million shares over the coming weeks.

Cash-Strapped and Out of Time

Newsmax will receive none of the proceeds. The company reported a net loss of $8.4 million in Q1. As of March 31, 2025, it had $15.1 million in cash and a burn rate of $2.8 million per month, giving it a runway of five to six months.

One immediate source of cash: 6.9 million warrants that Yorkville can exercise at $1.92 per share. Exercising all would bring Newsmax $13.3 million in cash—but at the cost of 6.9 million new shares dumped into the market. With a nearly sevenfold return available at current prices, Yorkville has every incentive to pull the trigger.

Still, $13.3 million won't be enough. If the stock price holds, we expect Newsmax to announce a secondary or at-the-market (ATM) offering. But since Tuesday, the stock price has fallen from nearly $20.00 to $16.00—an early sign of an unwinding, likely driven by increasing awareness of the dilution risk. Further declines could stall additional offerings.

How Voting Control Could Change

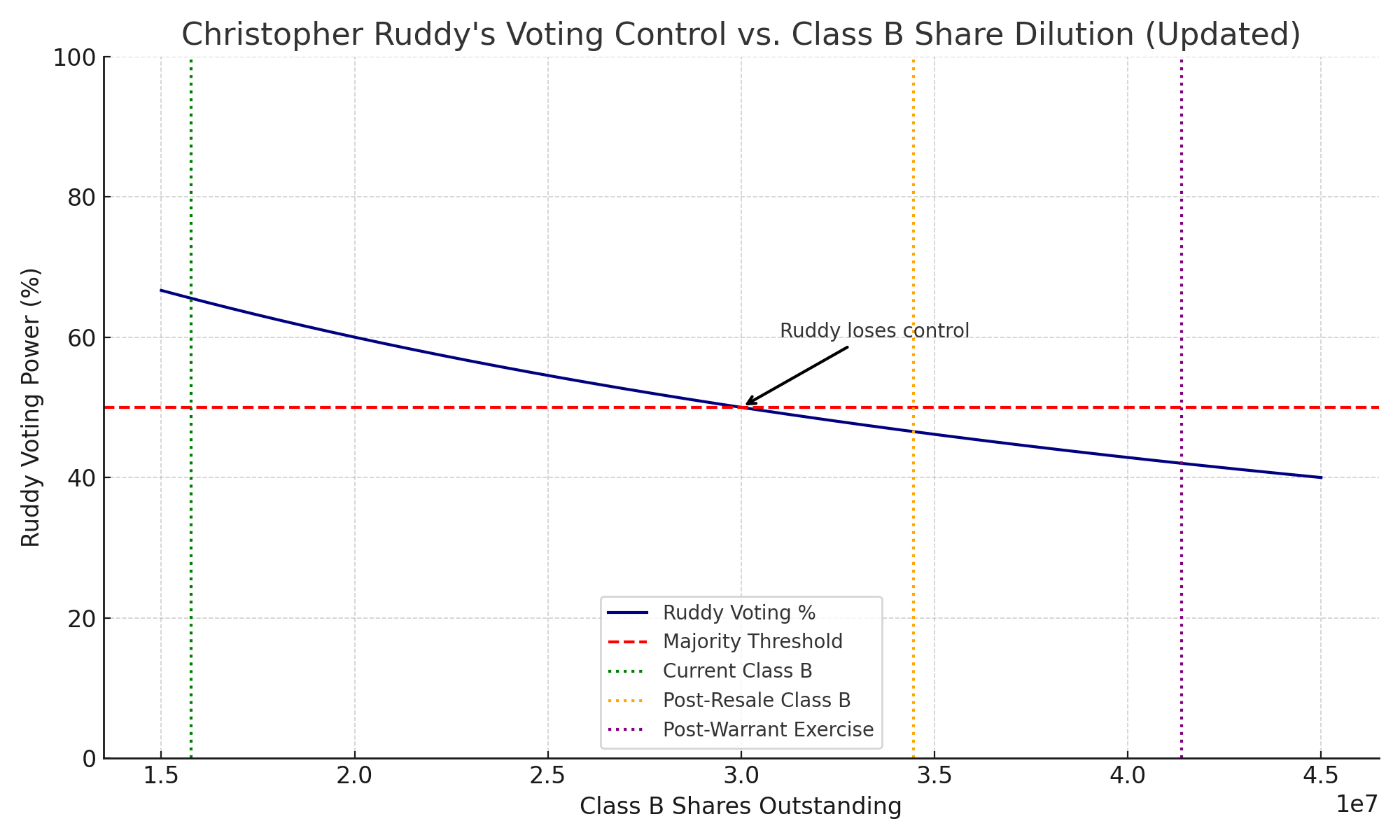

A wild card in the Newsmax story is founder Christopher Ruddy, who owns all three million outstanding shares of Class A common stock. Each Class A share carries 10 votes, while Class B shares carry just one. As of March 31, 2025, Ruddy held over 65.5% of total voting power.

Under NYSE rules, an issuer is a "controlled company" if one entity owns over 50% of voting power. Newsmax qualifies, exempting it from many governance safeguards meant to protect minority shareholders. Ruddy can unilaterally approve financings, related-party deals, or board appointments. He may greenlight dilutive deals with zero shareholder oversight.

However, if Class B shares more than double, Ruddy could lose voting control. That scenario becomes plausible if Yorkville exercises all 6.9 million warrants, causing the underlying shares to be issued. Ruddy will retain majority voting control only if fewer than 27 million Class B shares are outstanding. As of May 15, 2025, there were 15.8 million.

Playbook for Traders

We will target short entry on a bounce to $17.00 or higher, scaling in via VWAP fades and intraday strength. Our short-term cover target is $12.00, the first support zone. In the medium term, we expect support around $8.00 as the float expands. Long term, the price floor could drop to $2.00 or $3.00, near the warrant strike price.

Member discussion