Why Luminar Technologies (LAZR) Is Still a Great Short: Dilution, Debt, and Death Spiral

If you're a short seller, chances are you're familiar with Luminar Technologies, Inc. (LAZR). The lidar company was famously accused of trying to pass off a photo of a rival's chip as its own in a 2023 investor day presentation, as chronicled in multiple news stories and shareholder lawsuits. Luminar's Stanford dropout founder, Austin Russell, was the subject of a fawning profile in Forbes—a publication he attempted to buy. Last month, Russell resigned as president, CEO, and chairman of Luminar after the board's audit committee conducted an ethics inquiry.

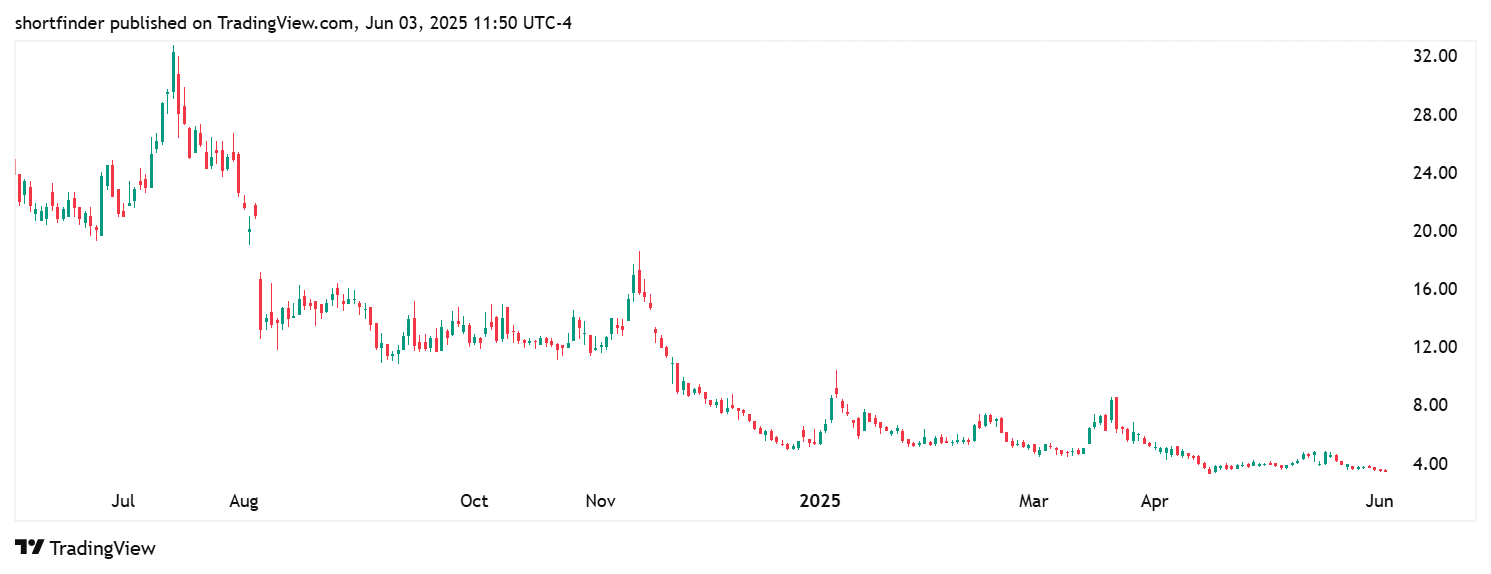

Luminar went public in 2020 through a reverse merger with a special purpose acquisition company (SPAC) formed by The Gores Group. Its stock quickly soared to an all-time high of $627 per share (split adjusted), briefly giving the company a market cap of $11 billion. Since then, the stock has plunged 97%. In November 2024, after trading below $1.00 per share for more than 30 days, Luminar executed a 1-for-15 reverse stock split to regain Nasdaq compliance. Yesterday, the stock closed at $3.52 per share.

You could be forgiven for thinking the moment to short Luminar has passed. But you would be wrong. This stock is on a one-way trip to zero, reverse splits be damned. Luminar has never generated positive cash flow. In Q1 2025, it burned through $44.2 million of cash, ending the quarter with just $59 million in cash, $486 million in debt, an $81 million net loss, and a stockholders' deficit of $262 million.

Amid this grim picture, Luminar on May 19, 2025 entered into a $200 million convertible preferred stock financing with hedge fund YA II PN, Ltd., managed by notorious dilution enabler Yorkville Advisors Global, LP. Luminar agreed to sell up to 200,000 convertible preferred shares at a 4% discount to par in registered direct offerings of up to $35 million every 60 to 90 days.

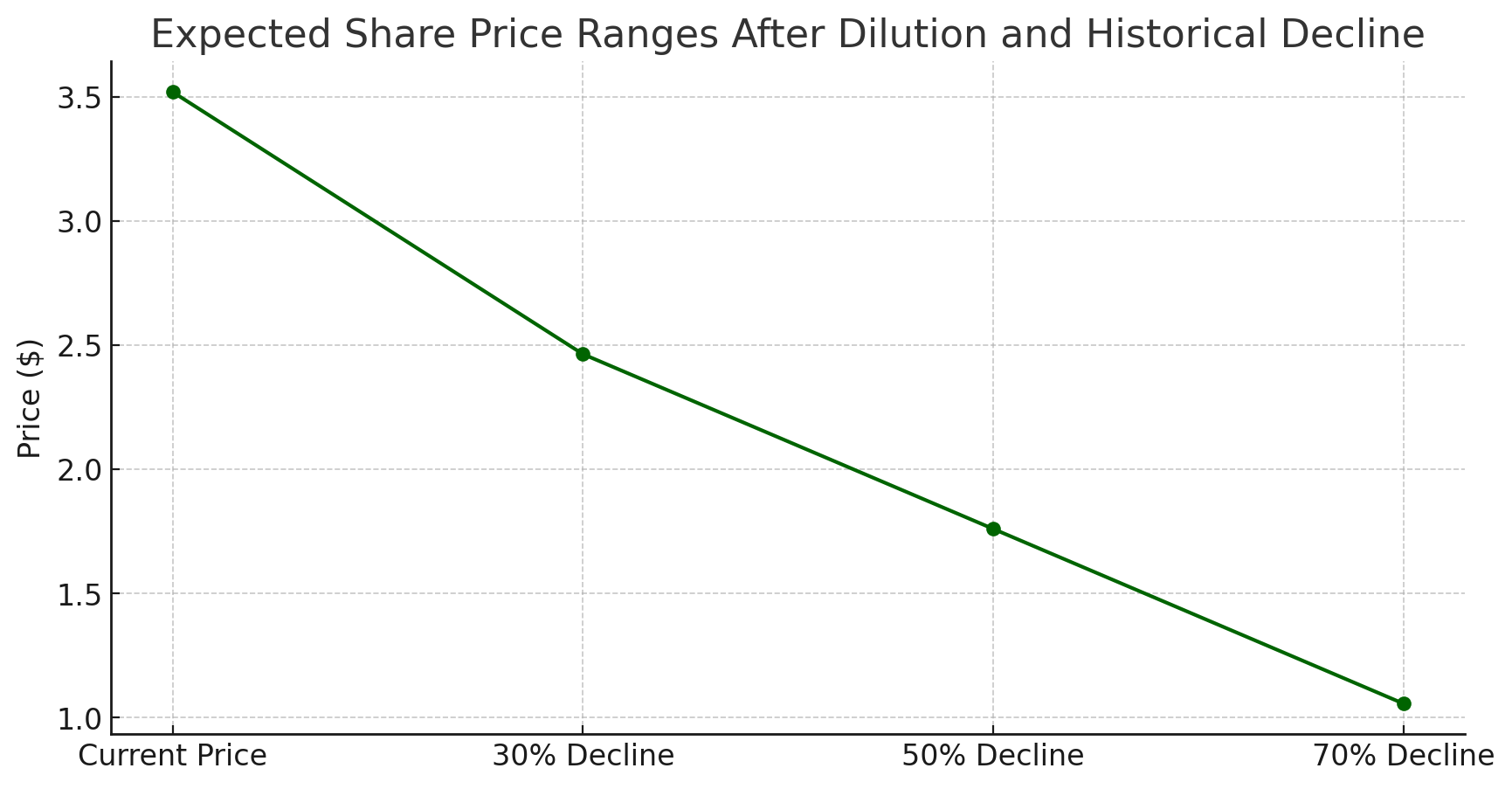

Each share has a $1,000 stated value and is convertible at the holder's option at the lesser of $4.752 or 95% of the lowest volume-weighted average price (VWAP) over the five trading days prior to conversion—with a floor price of $0.792.

That rock-bottom floor price is especially dangerous. If the stock falls to $0.792, each preferred share would convert into about 1,262 common shares. The likely result is a death spiral: as more shares are converted and dumped into the market, selling pressure drives down the price, triggering even more conversions and accelerating dilution. Full conversion of the preferred shares could more than double Luminar's current float.

If that weren't enough, in April 2025 Luminar expanded its existing at-the-market (ATM) offering by $75 million, bringing the total to $209 million of common stock available for gradual, unpredictable sale. The ATM expansion followed debt-for-equity swaps in March 2025 in which the company exchanged $18.2 million of convertible notes for 1.95 million new shares, reducing interest expense but fattening the float.

This summer, we'll be monitoring Luminar's SEC filings for updates on share conversions, cash burn, and debt servicing. Continued conversions and deteriorating cash flow may deepen the stock's decline. In the fall, we'll evaluate the position for potential covering—especially if the stock nears the $0.792 floor price, where dilution may begin to stabilize and the returns from a short position may diminish.

Member discussion